Synthetic identity fraud happens when criminals blend real and fake information to create believable profiles that pass as legitimate. They steal data from vulnerable groups, build credit histories, and use fake documents to avoid detection. To combat this, you need advanced detection tools like machine learning, multi-layered verification, and industry collaboration. If you continue exploring, you’ll uncover effective strategies to identify and prevent these sophisticated scams.

Key Takeaways

- Criminals blend real personal data with fake details to create believable synthetic identities that pass initial verification checks.

- They establish credit histories over time through small transactions to inflate credit scores and appear legitimate.

- Detection is challenging because synthetic identities combine real and fake data, making them difficult for traditional systems to identify.

- Advanced detection methods like machine learning, anomaly detection, and multi-layered verification are essential to combat fraud.

- Financial institutions can reduce risk by monitoring behaviors, securing personal data, and collaborating for threat intelligence sharing.

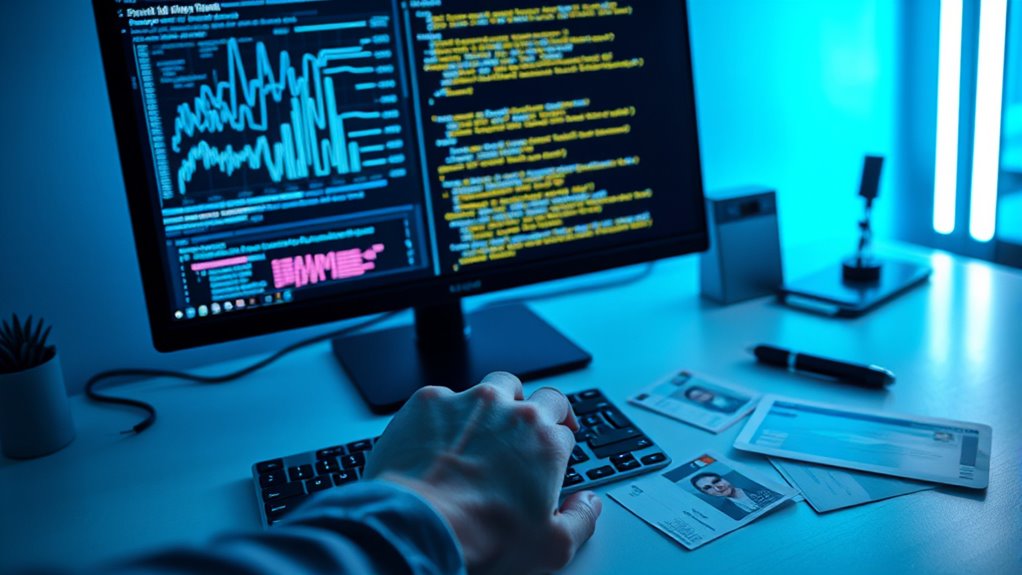

The Construction of Synthetic Identities

The construction of synthetic identities begins with criminals acquiring real personal data, often targeting vulnerable groups like children, the elderly, or homeless individuals to obtain authentic Social Security Numbers (SSNs). Once they have a legitimate SSN, they combine it with fake details such as fictional names, addresses, and birthdates. They often use public data sources to make these details appear credible, helping the identity pass initial checks. Over time, fraudsters build credit histories for these identities by making small transactions and payments, making the profiles seem legitimate. Their goal is to inflate the credit score and establish a convincing financial footprint. This methodical process allows them to maximize their gains before cashing out, all while evading traditional detection methods. Understanding the traits of deception can help financial institutions identify suspicious activities early on. Additionally, credit profile construction involves carefully managing the financial activities associated with these synthetic identities to avoid detection. Recognizing patterns such as inconsistent data or irregular transaction behaviors is crucial in combating synthetic identity fraud, which often involves manipulating credit reporting systems to appear more credible.

Techniques Used by Fraudsters to Build and Maintain Fake Profiles

Fraudsters employ a variety of sophisticated techniques to build and maintain convincing fake profiles. They carefully gather real data, often stealing SSNs from vulnerable populations, then blend it with fabricated details like names and addresses to craft believable identities. To keep these profiles active and credible, they use fake documents and manipulate public records to pass verification checks. They also establish credit histories over months or years, simulating genuine financial behavior. This long-term effort helps inflate credit scores, making the fake profiles appear legitimate. Additionally, understanding tableware, the cultural significance and trends, can help identify inconsistencies in profiles that claim to belong to specific regions or lifestyles. Recognizing breed characteristics can also aid in detecting false associations or misrepresented dog breeds in online profiles. Implementing advanced security measures can further prevent the creation of these fraudulent profiles and protect both consumers and merchants. Being aware of identity verification processes can help identify attempts at forgery and improve overall fraud prevention strategies. Staying informed about fraud detection techniques is essential for effective countermeasures against synthetic identity fraud.

Challenges in Detecting Synthetic Identity Fraud

Detecting synthetic identity fraud is tough because fraudsters use blended data that combines real and fake information, making it look legitimate. Traditional detection systems often miss these identities because they can pass initial checks and appear credible over time. Plus, inconsistent detection methods across organizations add to the challenge, leaving many cases underreported. Implementing standardized detection methods and the strategies within detection processes can help identify subtle discrepancies that might otherwise go unnoticed. Incorporating advanced analytics can further improve the accuracy of fraud detection by identifying complex patterns. Additionally, understanding raw food benefits can help organizations develop better verification processes by emphasizing the importance of genuine, unaltered data. Recent research into sound healing science reveals that utilizing specific frequencies and patterns can enhance pattern recognition, which could be adapted for more effective fraud detection techniques.

Blended Data Complexity

Blended data complexity presents a significant challenge in identifying synthetic identity fraud because it combines genuine and fabricated information in ways that appear legitimate. This mix makes it hard to distinguish real from fake, especially when fraudsters carefully craft identities that pass initial checks. You’ll face obstacles like:

- Convincing Data Mixes: Real and fake details blend seamlessly, confusing detection systems.

- Legitimate-Looking Profiles: Fraudulent identities mimic real credit behaviors, hiding their true nature.

- Inconsistent Data Sources: Variations across databases make cross-checking unreliable and create confusion for detection algorithms.

- Evolving Tactics: Fraudsters adapt, creating more sophisticated blends that challenge existing detection methods.

- Data Verification Challenges: The vetted nature of data in Mother Baby Kids highlights the importance of thorough validation processes, which are often overwhelmed by complex blended data. Additionally, advanced detection tools are essential to identify subtle inconsistencies that escape traditional methods. Incorporating machine learning algorithms can further improve accuracy by recognizing complex patterns within blended datasets. Moreover, understanding the data integration process can help detect anomalies that arise from conflicting information sources. This complexity means you must stay vigilant, using advanced tools to uncover inconsistencies and expose the artificial fabrications hiding within legitimate-looking data.

Limited Detection Systems

Limited detection systems pose a significant challenge because many current tools struggle to identify synthetic identities that appear legitimate. These systems often rely on traditional checks designed for real identities, which synthetic profiles can easily pass by blending genuine and fabricated data. Since synthetic identities lack a clear victim, fraud detection becomes even more complex, making it harder to flag suspicious activity early. Inconsistent standards across organizations and jurisdictions hinder exhaustive detection efforts, allowing fraudsters to exploit gaps. Additionally, advanced fraudsters adapt quickly, using sophisticated techniques to mimic legitimate behaviors. This constant evolution means existing tools often lag behind, missing warning signs. Without continuous updates and more nuanced detection methods, many synthetic identities remain undetected, increasing financial losses and undermining trust in digital financial systems. Moreover, integrating innovative sound design techniques from various fields could inspire new approaches to anomaly detection in financial data. Self-awareness and understanding emerging threats can also enhance the development of adaptive detection strategies. Recognizing the importance of preppy dog names and other themed naming conventions in cultural contexts can provide insights into patterns of deception, as fraudsters often mimic legitimate branding and naming trends to create convincing synthetic profiles.

The Impact of Synthetic Identity Crime on Financial Systems

Synthetic identity fraud causes significant financial losses for lenders and institutions, often going unnoticed until substantial damage occurs. These losses weaken the stability of financial systems and reduce trust among consumers and partners. As fraud grows more sophisticated, operational costs increase, forcing organizations to spend more on detection and prevention efforts.

Financial Losses Amplified

How significant are the financial losses caused by synthetic identity fraud, and what impact do they have on the broader financial system? These losses are staggering, often reaching billions annually, and they ripple across the economy. You face the consequences through higher costs and tightened lending standards. Consider these impacts:

- Massive financial drain—lenders suffer huge payouts, sometimes in the millions, that threaten their stability.

- Increased operational costs—investing in advanced detection tools cuts into profits and raises prices for consumers.

- Market volatility—large-scale fraud erodes confidence and can trigger economic instability.

- Strained resources—law enforcement and institutions divert funds from growth efforts to combat fraud.

These losses threaten your financial environment, making it harder to access affordable credit and undermining trust in the system.

Eroding System Trust

As synthetic identity fraud continues to grow, it considerably undermines trust in the entire financial system. When fraudsters create fake identities that pass initial checks, it becomes harder for you to distinguish legitimate customers from malicious actors. This erosion of trust affects your confidence in digital transactions and credit assessments. As losses mount and detection becomes more complex, financial institutions may tighten security measures, making it more difficult for genuine customers to access services. The widespread perception that the system is unreliable can discourage people from engaging in online banking or credit applications altogether. Over time, this skepticism damages the reputation of financial providers and weakens the foundation of trust that underpins the entire system. Ultimately, synthetic identity fraud threatens the integrity and stability of your financial ecosystem.

Increased Operational Costs

The rise of synthetic identity fraud forces financial institutions to spend more on fraud detection and prevention efforts. You’ll face escalating costs as you implement advanced tools and expand staff training to keep up with sophisticated schemes. This relentless battle increases operational expenses in several ways:

- Investing in cutting-edge technology to identify complex, blended identities.

- Hiring specialized personnel to investigate suspicious activities and verify identities.

- Implementing multi-layered verification processes that slow down customer onboarding.

- Managing higher false-positive rates, which require additional resources to review legitimate customers.

These expenses strain budgets, reduce profitability, and complicate compliance efforts, making it harder to balance security with customer experience. Synthetic identity fraud isn’t just a threat—it’s also a financial drain on your entire system.

Strategies and Technologies for Prevention and Detection

To effectively combat synthetic identity fraud, organizations must implement a combination of advanced technologies and strategic measures. Machine learning and AI analyze behavioral patterns and detect anomalies that signal fraud. Multi-layered verification methods, including document checks, biometrics, and data cross-referencing, strengthen identity validation. Regular credit report monitoring and personal data security help reduce individual risk. Collaboration with other financial institutions, technology providers, and regulators is vital for sharing threat intelligence and developing unified defenses. You should also adopt real-time monitoring systems to flag suspicious activity immediately. By integrating these technologies and strategies, you improve detection accuracy and create a resilient defense that intercepts synthetic identities before they cause significant damage.

Building a Resilient Defense: Best Practices for Organizations

Building a resilient defense against synthetic identity fraud requires organizations to adopt all-encompassing and proactive best practices. First, invest in advanced detection tools that leverage machine learning and AI to identify suspicious patterns early. Second, implement multi-layered verification, such as biometric checks, document validation, and data cross-referencing, to strengthen identity confirmation. Third, foster collaboration across industry sectors and regulators to share intelligence and create unified standards. Fourth, educate your team and customers about emerging fraud tactics and best practices to reduce risks and improve response times. By taking these steps, you actively close vulnerabilities and build a robust, adaptable defense, making it harder for fraudsters to succeed and ensuring your organization stays protected against evolving synthetic identity threats.

Frequently Asked Questions

How Quickly Can Synthetic Identities Be Created and Used for Fraud?

You can create and start using a synthetic identity within days or weeks, depending on your goals. Fraudsters often quickly gather real data like stolen SSNs and combine it with fabricated details. They then build credit profiles over months, making these identities look legitimate. The faster they establish a credible history, the sooner they can exploit the fake identity for financial gain, often before detection systems catch on.

What Role Does AI Play in Both Executing and Detecting SIF?

AI acts like a double-edged sword in SIF—cutting both ways. Criminals harness its power to craft convincing synthetic identities, making their frauds smoother and harder to spot. At the same time, you can deploy AI as a vigilant guardian, analyzing patterns and catching anomalies before they cause damage. It’s a high-stakes game where AI’s role is vital—either as an accomplice or a protector.

Are Certain Industries More Vulnerable to Synthetic Identity Fraud?

You should know that financial services, including banks, credit unions, and payday lenders, are most vulnerable to synthetic identity fraud. Retailers offering credit, auto lenders, and government agencies providing benefits also face high risks. These industries rely heavily on credit checks and personal data, making them prime targets. To protect yourself, stay vigilant with your personal info and monitor your credit reports regularly to catch suspicious activity early.

How Do Cross-Border Transactions Complicate SIF Detection?

Cross-border transactions complicate SIF detection because they involve multiple jurisdictions, each with different regulations, data sharing policies, and verification standards. You face challenges tracking and verifying identities across borders, which makes it easier for fraudsters to exploit gaps. Additionally, inconsistent data quality and limited cooperation between international agencies hinder your ability to detect suspicious activity quickly, increasing the risk of undetected synthetic identities spreading across global financial networks.

What Legal Steps Are Being Taken to Combat Synthetic Identity Fraud?

Like a modern-day knight defending the domain, legal steps aim to combat synthetic identity fraud through stricter regulations. Authorities are implementing enhanced data-sharing protocols, enforcing harsher penalties for fraudsters, and requiring stronger identity verification standards. Courts are increasingly recognizing SIF as a serious crime, leading to more convictions. Collaborations between governments and financial institutions are also forming to develop better detection tools, making it harder for fraudsters to operate undetected.

Conclusion

To combat synthetic identity fraud, you must understand its construction, recognize the techniques fraudsters use, and stay aware of detection challenges. You need to implement advanced strategies, leverage innovative technologies, and foster a culture of vigilance. You must continuously adapt, refine your defenses, and prioritize education. By doing so, you can build a resilient shield, strengthen your defenses, and protect your organization from the evolving threats that synthetic identity crime presents.