To stop unwanted background inquiries, you can freeze your credit records by contacting the three major bureaus—Equifax, Experian, and TransUnion—online, by phone, or mail. You’ll need to verify your identity and receive a PIN or password to manage the freeze. Keep this information secure so you can lift the freeze when needed. Staying proactive with your credit freeze and understanding how to manage it helps protect your personal info—learn more to stay fully protected.

Key Takeaways

- Contact each of the three major credit bureaus—Equifax, Experian, and TransUnion—to initiate a credit freeze.

- Verify your identity with personal details like Social Security number, date of birth, and current address.

- Request a PIN or password to manage and lift the freeze when needed.

- Keep your PIN/password secure to prevent unauthorized unfreezing or management.

- Use the freeze proactively to block background inquiries and monitor your credit reports regularly for suspicious activity.

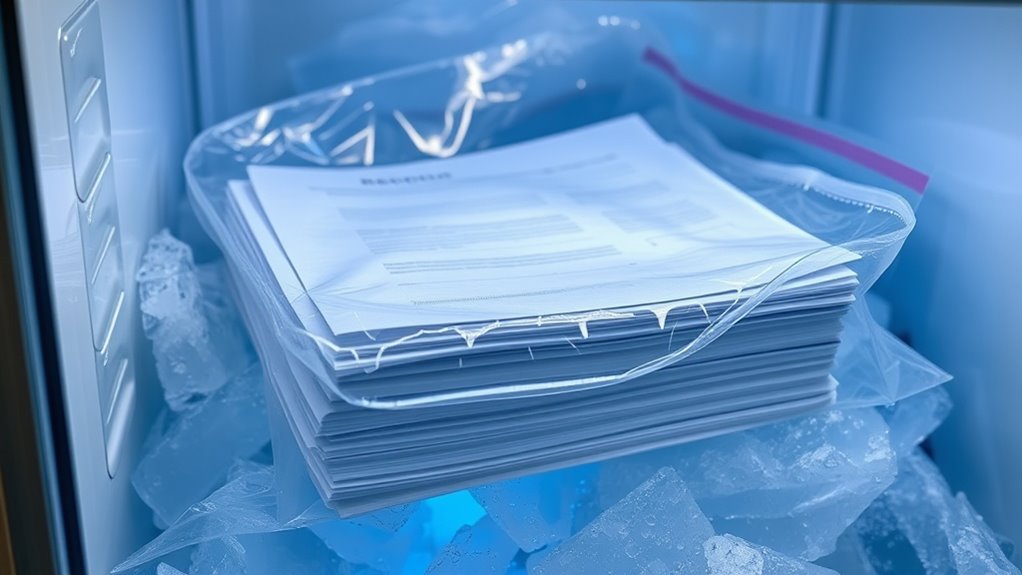

Have you ever wondered how to effectively freeze your records to protect your data? Freezing your records is a powerful step toward preventing unauthorized access and safeguarding your personal information. When you initiate a credit freeze, you fundamentally lock your credit report, making it difficult for anyone—even potential identity thieves—to open new accounts in your name. This process is particularly useful if you’re concerned about identity theft or suspect that your personal data might be compromised. By placing a credit freeze, you reduce the risk of fraudsters successfully using your information to commit financial crimes.

Freezing your records helps prevent unauthorized access and protects your personal information from identity theft.

To start, you’ll need to contact each of the three major credit bureaus—Equifax, Experian, and TransUnion—and request a credit freeze. This process can be done online, by phone, or through mail, depending on your preference. When you request a credit freeze, you’ll be asked to verify your identity with personal details such as your Social Security number, date of birth, and address. Once the freeze is in place, no new credit accounts can be opened in your name without your explicit approval. You’ll receive a PIN or password, which you’ll need to lift or temporarily lift the freeze if you plan to apply for new credit or loans.

It’s vital to keep your PIN or password secure because it’s the key to unfreezing your records when necessary. If you’re worried about someone trying to access your information maliciously, a credit freeze acts as a barrier, preventing fraudsters from exploiting your data. This proactive measure is especially indispensable if you’ve experienced a data breach or have reason to believe your identity has been compromised. Remember, a credit freeze doesn’t affect your credit score or your ability to use your existing credit accounts; it simply restricts access to your credit report until you decide to lift the freeze. Additionally, understanding the security features of eSIM technology can help you further protect your digital identity from remote attacks.

While a credit freeze is an effective tool against identity theft, it’s not a complete solution. You should also monitor your credit reports regularly for suspicious activity and consider placing fraud alerts if you suspect your data has been compromised. By taking these steps, you’re actively controlling access to your records, making it much harder for anyone to misuse your personal information. Freezing your records empowers you to maintain better control over your financial identity and avoid the long-lasting damage that can come from identity theft. In today’s digital age, acting swiftly to freeze your records can be one of the most effective ways to protect yourself from ongoing fraud and unauthorized background inquiries.

Frequently Asked Questions

How Long Does It Take to Freeze My Records?

When you freeze your records, it typically takes about 24 to 72 hours for the freeze to become active, depending on the credit bureaus. During this time, credit monitoring services can alert you to any suspicious activity, helping prevent identity theft. Once frozen, your credit reports stay secure, and unwanted background inquiries are blocked. Keep in mind, unfreezing your records also takes a few days, so plan accordingly.

Can I Unfreeze My Records Anytime I Want?

You can definitely unfreeze your records anytime you want, making it easy to resume regular background checks and credit reporting. Simply contact the credit bureaus or use their online portals to lift the freeze temporarily or permanently. Remember, unfreezing is usually swift, so you won’t wait long to regain full access. This flexibility allows you to control who can see your background information and manage your credit reporting seamlessly.

Will Freezing My Records Affect My Credit Score?

Freezing your records doesn’t impact your credit score, so you can keep your credit monitoring steady without worry. It’s a smart move to prevent identity theft and unauthorized credit checks. When you freeze your records, lenders can’t access your credit info unless you lift the freeze. This adds an extra layer of security, helping protect your personal info while still allowing you to manage your credit when needed.

How Much Does It Cost to Freeze Records?

The cost of record freezing varies depending on your state and whether you’re freezing your credit, background, or other records. Typically, freezing your records is free in many states, but some may charge a small fee per freeze or thaw. It’s a good idea to do a cost comparison between providers to find the most affordable options. Remember, freezing your records helps protect your privacy without considerably impacting your credit score.

Are There Different Procedures for Different States or Agencies?

Imagine stepping into a library, each state and agency with its own set of rules on how to freeze your records. You’ll find that procedures vary—some states require online forms, others need written requests, and agencies might ask for specific identification. You need to check state-specific policies and agency variations to guarantee you follow the correct process, making your record freeze smooth and effective across different jurisdictions.

Conclusion

Now that you’ve frozen your records, you’ve fortified your freedom from foolish inquiries. Feel the fierce fortress firewall flanking your finances, forestalling unwanted fetchers. With your records safely sealed, you stand strong, safeguarding your security and serenity. Remember, this simple step shields your sovereignty, stopping sneaky searches in their tracks. So, stay vigilant, stay vigilant, and keep your personal peace pristine by proactively protecting your records from prying eyes.