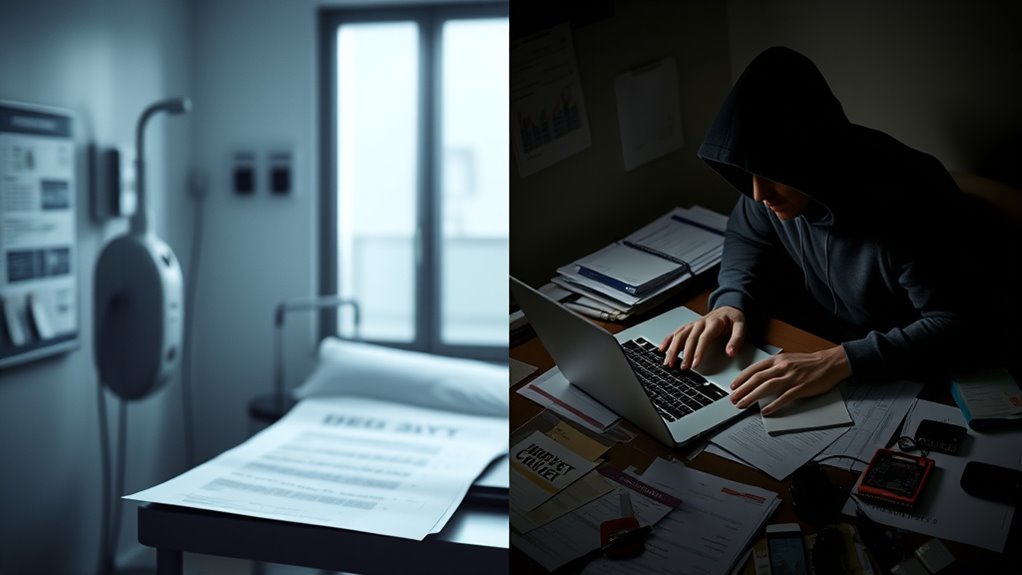

There are several types of identity theft you should be aware of. Financial identity theft happens when thieves access your bank accounts or credit cards to steal funds or open new accounts in your name. Medical and criminal identity theft involve using your information for false healthcare claims or legal issues. Child, elder, and government benefit theft exploit vulnerable populations or system gaps to commit fraud. Understanding how these methods work helps you better protect yourself from falling victim to these schemes.

Key Takeaways

- Financial identity theft involves unauthorized access to bank accounts, credit cards, or loans, leading to financial loss and credit damage.

- Medical and criminal identity theft misuse personal info for healthcare fraud or law enforcement encounters, causing legal and medical issues.

- Child, elder, and government benefit theft exploit vulnerabilities to access social services, drain savings, or commit fraud over extended periods.

- Thieves often use phishing, data breaches, or weak security to steal personal info and commit various types of identity theft.

- Prevention includes monitoring records, using strong passwords, enabling two-factor authentication, and utilizing identity theft protection services.

Financial Identity Theft

Financial identity theft occurs when someone gains unauthorized access to your bank accounts, credit cards, or loans using your personal information. Thieves often target your details to open new accounts, make purchases, or withdraw funds without your permission. This can cause immediate financial loss and damage your credit score. Regularly reviewing your bank and credit statements is essential for spotting suspicious activity early. Stolen credit or debit card information is a common method of fraud, with criminals exploiting weak security measures or phishing scams. In 2023, financial identity theft caused over $10 billion in losses in the U.S., highlighting its severity. Staying vigilant and monitoring your accounts helps you catch fraud quickly, reducing potential damage and restoring your financial security. Additionally, utilizing security measures like two-factor authentication can further protect your financial information from theft, especially when combined with identity theft protection services.

Medical and Criminal Identity Theft

Medical and criminal identity theft involve the misuse of your personal information in ways that can have serious legal and health consequences. In medical identity theft, thieves use your details to receive medical care, submit false insurance claims, or obtain prescriptions. This can lead to incorrect medical records, denied coverage, and unexpected bills. Criminal identity theft occurs when someone provides your information to law enforcement during an arrest or citation, resulting in a criminal record under your name. This can cause legal issues, wrongful warrants, or employment problems. Both forms of theft often involve trusted individuals or stolen information from data breaches. To protect yourself, regularly review your medical bills, insurance statements, and public records for suspicious activity. Staying vigilant helps minimize these complex, damaging threats. Additionally, awareness of identity theft methods can help you recognize and prevent potential attacks before they cause harm, and understanding how creative practice can foster problem-solving skills may aid in developing strategies to identify and respond to such threats. Being aware of security practices is also essential for safeguarding sensitive information and reducing vulnerability to these types of theft. Implementing preventive measures such as secure passwords and monitoring credit reports can further strengthen your defenses against these crimes.

Child, Elder, and Government Benefit Identity Theft

Child, elder, and government benefit identity theft pose unique risks because thieves exploit vulnerable populations or system gaps to commit fraud. You might not realize someone has stolen a child’s identity until years later, when it’s difficult to resolve. Monitoring personal information is crucial to detecting early signs of theft and preventing long-term damage. Implementing identity protection strategies can help safeguard sensitive data more effectively. Elder fraud can drain savings and compromise trust, often involving trusted individuals. Thieves using stolen identities for government benefits can access services meant for those who truly need them, diverting resources and causing delays for others. Additionally, the use of high-resolution projectors can help identify discrepancies in visual records, aiding in fraud detection. Be aware of these risks:

- Criminals open accounts using a child’s clean credit history, hiding their tracks until adulthood.

- Seniors may unknowingly share sensitive info, risking financial and emotional harm.

- Fraudulent claims for Social Security or Medicare can deny genuine benefits.

- Fake government benefit applications divert funds and create legal issues.

- Monitoring and safeguarding personal info is essential to prevent long-term damage. Vulnerable populations are often targeted because thieves capitalize on system gaps and limited oversight.

Frequently Asked Questions

How Can I Protect My Personal Information From Being Stolen?

To protect your personal information, you should regularly monitor your bank and credit statements for suspicious activity. Use strong, unique passwords and enable two-factor authentication on your accounts. Be cautious when sharing sensitive info online or over the phone, and avoid storing personal details in unsecured locations. Shred sensitive documents before disposal, and stay informed about common scams to recognize potential threats early.

What Are Signs of Identity Theft I Should Watch For?

You might notice signs of identity theft if you find unfamiliar charges on your bank or credit card statements, receive bills for services you didn’t use, or get notices about accounts you didn’t open. Your credit report could show new accounts or inquiries you didn’t authorize. Keep an eye out for unexpected IRS notices, medical bill discrepancies, or legal alerts. Regular monitoring helps catch these issues early and protects your identity.

How Long Does It Typically Take to Resolve Identity Theft Issues?

Resolving identity theft can take anywhere from a few weeks to several months, depending on the complexity of the case. You should act quickly by filing reports with authorities, notifying your bank and credit bureaus, and disputing fraudulent accounts. Staying organized, following up regularly, and being patient are key. The process involves verifying your identity, correcting records, and monitoring your credit to prevent future issues.

Can Identity Theft Occur Through Social Media or Email Scams?

Yes, identity theft can happen through social media and email scams. While you might think sharing personal details online is harmless, scammers often use fake profiles or phishing emails to trick you into revealing sensitive information. They craft convincing messages that look legitimate, luring you into clicking malicious links or providing your data. Stay cautious, verify sources, and never share personal info to protect yourself from these deceptive tactics.

What Steps Should I Take if I Suspect My Identity Has Been Stolen?

If you suspect your identity has been stolen, act quickly. Contact your bank and credit card companies to freeze accounts and report suspicious activity. File a police report and notify the Federal Trade Commission at IdentityTheft.gov. Monitor your credit reports for unfamiliar accounts or charges. Consider placing a fraud alert or credit freeze. Keep detailed records of all communications and updates to protect your rights and help resolve the issue efficiently.

Conclusion

Now that you know the different types of identity theft, you can stay vigilant and protect yourself from these sneaky criminals. Think of it like guarding your own kingdom—watch for suspicious activity and act quickly. Remember, even in the age of smartphones and smart homes, a little old-fashioned caution goes a long way. Stay alert, stay safe, and don’t let identity thieves hijack your story—because your identity is your most valuable treasure.