During COVID‑19, your increased reliance on online platforms and digital transactions created more opportunities for cybercriminals to target personal data. Economic hardships led many to commit identity theft for quick cash or to access unemployment benefits through scams. Criminals also exploited relief programs with fake websites and phishing, while advanced tools made attacks more scalable. Law enforcement struggles to keep up, and vulnerable groups face added risks. If you want to know how to protect yourself, keep exploring further.

Key Takeaways

- Increased reliance on online platforms during the pandemic created more opportunities for cybercriminals to exploit vulnerabilities.

- Economic hardships motivated criminals to commit identity theft for quick financial gains amid job losses.

- Expansion of relief programs and relaxed verification processes made it easier for scammers to steal personal data.

- Advances in cybercrime tools and AI-enabled scams facilitated large-scale and convincing identity theft schemes.

- Heightened digital activity and reduced cybersecurity awareness heightened victims’ vulnerability during COVID-19.

Increased Dependence on Digital Platforms and Online Transactions

As more people rely on digital platforms for daily activities, the risk of identity theft has grown considerably. You’re increasingly using online banking, shopping, and social media, which creates more opportunities for cybercriminals to target your personal information. Cybercriminals exploit vulnerabilities in websites, apps, and insecure Wi-Fi networks to access sensitive data. Phishing scams and fake login pages trick you into revealing passwords or financial details. The surge in online transactions during the pandemic means you’re sharing more personal data than ever before. Without proper security measures, your information becomes an easy target. As digital dependence intensifies, you need to stay vigilant, use strong passwords, enable two-factor authentication, and be cautious about sharing personal details online.

Economic Hardship and Financial Motivations

Economic hardship during the pandemic has motivated some individuals to turn to fraudulent schemes, including identity theft, in search of quick financial relief. With many facing job losses and reduced income, desperate people see stolen identities as a way to access funds or benefits they wouldn’t otherwise qualify for. Criminals exploit this desperation by targeting vulnerable victims, often using their personal information to fraudulently obtain unemployment benefits, loans, or government aid. The promise of immediate cash makes these schemes appealing to both perpetrators and victims. As financial stress intensifies, so does the temptation to engage in illegal activities. This environment creates a cycle where economic hardship fuels identity theft, which in turn deepens victims’ financial struggles.

Expansion of Government Benefits and Stimulus Scams

During the pandemic, government benefit programs expanded rapidly, attracting scammers looking to exploit these relief efforts. You might encounter scams that use fake applications or phishing to steal personal information and file false claims. As these schemes grow more sophisticated, it’s vital to stay vigilant and verify the legitimacy of any benefit-related communication. Understanding credit card terms can help you recognize suspicious requests and avoid falling victim to fraud. Awareness of identity theft prevention strategies can help protect your personal data from falling into the wrong hands. Additionally, increased use of Pimple Patches in skincare routines highlights how targeted solutions are becoming more accessible for consumers. Recognizing authorized government channels is essential to avoid falling for false claims and scams.

Increased Benefit Fraud Risks

The surge in government benefits during the COVID-19 pandemic created a prime target for fraudsters seeking quick financial gains. They exploited the increased volume of claims and relaxed verification processes to access funds using stolen identities. You might encounter schemes where criminals submit false applications or hijack legitimate accounts. These frauds not only drain resources but also delay aid for those truly in need. Additionally, the expansion of benefits led to legal considerations, which can complicate enforcement and recovery efforts. Implementing identity verification measures is essential to combat these schemes effectively. Criminals often leverage identity theft techniques to impersonate individuals and bypass security checks, making detection more challenging. These tactics increase the risk of identity theft, making it easier for criminals to steal funds and complicate efforts to track and prevent deception. Staying vigilant is vital to protect your information from falling into the wrong hands.

Furthermore, advanced cybersecurity practices are necessary to defend against sophisticated identity theft schemes that have grown alongside these benefits.

Stimulus Scam Tactics Rise

As government benefits and stimulus payments increased rapidly during the pandemic, scammers seized the opportunity to exploit these funds through sophisticated fraud schemes. They used fake websites, phishing emails, and deceptive calls to trick individuals into revealing personal information. Some scammers impersonated government officials, claiming urgent action was needed to secure stimulus money, prompting victims to share sensitive data. Others created fake portals that looked legitimate to steal banking details or direct deposits. These tactics targeted unaware individuals, especially those unfamiliar with official channels. The rise in digital communication made it easier for scammers to reach many victims quickly. As a result, many people fell prey to stimulus scams, leading to significant financial losses and heightened identity theft risks. Additionally, a lack of awareness about warning signs can make individuals more vulnerable to these schemes.

Furthermore, the increased use of digital devices and online platforms during the pandemic has made it easier for scammers to execute these schemes and evade detection.

Exploitation of Relief Programs

The expansion of government benefits and stimulus programs during the pandemic created lucrative targets for fraudsters. They exploited these programs by submitting fake applications, stealing identities, and submitting false claims to access funds. This surge in scams drained resources and caused significant delays for genuine applicants. You need to be alert to how scammers pose as government officials or use phishing emails to trick you into revealing personal information. Criminals also create fake websites to steal data or direct victims to malicious links. These tactics make it easier for fraudsters to access benefits illegally. Staying vigilant, verifying official communications, and protecting your personal information are key to avoiding falling victim to these exploitation schemes. Additionally, the surge in online activity during the pandemic has increased the risk of falling for scams that target online security vulnerabilities. Being aware of identity protection strategies can further help prevent unauthorized access to your data. Recognizing signs of phishing attempts can help you avoid sharing sensitive information with malicious actors.

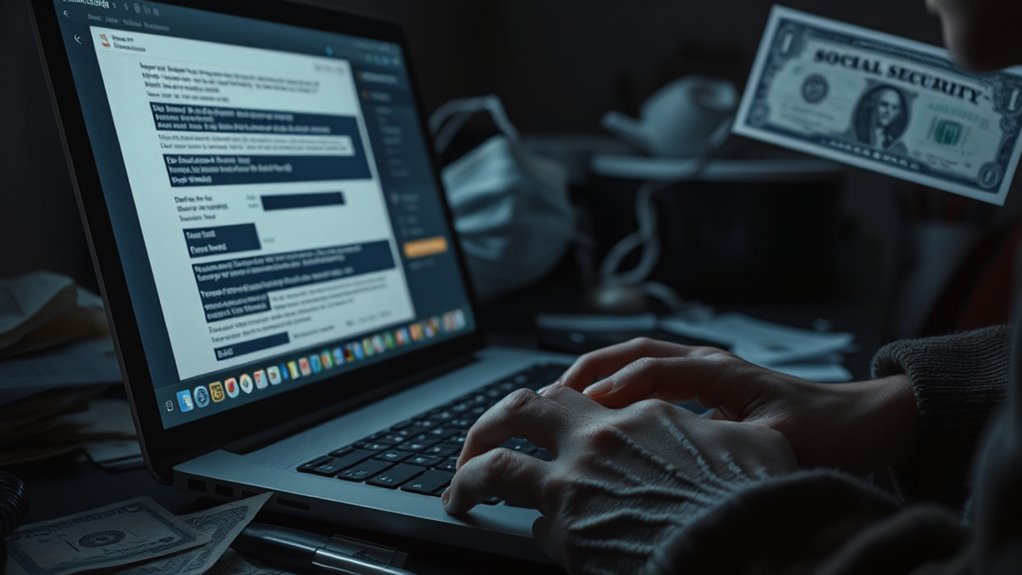

Advancements in Cybercrime Tools and Techniques

You should be aware that cybercriminals now use advanced digital scam technologies to target victims more efficiently. These sophisticated fraud tools allow attackers to automate attacks and scale their efforts across many individuals quickly. As these tools become more accessible, it’s vital to stay vigilant against evolving online threats that can compromise your personal information. Moreover, AI-driven cyberattack techniques pose new challenges, making it crucial to understand AI security measures to protect sensitive data effectively. Staying informed about cybersecurity trends can also help you recognize and defend against emerging scams before they impact you. Additionally, understanding sound recording techniques can enhance your awareness of digital security practices in multimedia environments. For example, knowledge of bicycle tire longevity in storage can help prevent equipment failures that might be exploited by cybercriminals seeking to access physical assets. Being aware of local store hours for beauty retailers can also help you plan secure shopping experiences during busy periods, reducing the risk of theft or fraud.

Digital Scam Technologies

Advancements in digital technologies have considerably expanded the arsenal of tools available to cybercriminals, making scams more sophisticated and widespread. You now face a variety of online fraud techniques that evolve quickly, often outpacing security measures. You may find it increasingly difficult to defend against these threats as cybercriminals use automation to target many victims simultaneously, increasing the scale of scams. They leverage encrypted channels to hide malicious activities, making detection harder. Additionally, new online fraud tools provide attackers with easier access to phishing kits, malware, and fake websites. These advancements enable scammers to craft more convincing and personalized attacks, increasing their success rates. The rise of AI in Education has also led to the development of more realistic deepfake videos and identity fraud methods, further complicating efforts to detect scams. Staying informed about cybersecurity trends can help you recognize and counter emerging threats more effectively. Understanding these technological trends is essential for developing better security strategies to protect yourself online.

Sophisticated Fraud Tools

Cybercriminals now leverage sophisticated tools that considerably enhance their ability to commit identity theft. These advanced resources streamline attacks, making it easier to target victims at scale. For example, they use automation to generate convincing phishing emails or scrape data from breached databases. They also deploy malware that captures login credentials or encrypts information for ransom. These tools often include features like anonymizing proxies or VPNs, which hide their location and complicate law enforcement efforts. Additionally, the integration of cybersecurity vulnerabilities into these tools allows criminals to exploit weaknesses in security systems more effectively.

Challenges in Legal Frameworks and Law Enforcement

Legal frameworks and law enforcement agencies face significant hurdles when combating identity theft, especially amid the complexities introduced by the COVID-19 pandemic. You often encounter jurisdictional issues as criminals operate across borders, making investigations difficult. Reporting systems are inconsistent, slowing down responses and hindering data collection. Limited resources strain agencies, reducing their capacity to investigate and prosecute cases effectively. Additionally, evolving tactics by fraudsters, like new digital scams, outpace existing laws and enforcement methods. These challenges create gaps that criminals exploit, allowing identity theft to flourish during the pandemic. Addressing these issues requires coordinated efforts, updated regulations, and increased resources to keep pace with rapidly changing criminal strategies.

Demographic Vulnerabilities and Psychological Impact

While legal and enforcement challenges create opportunities for identity thieves, understanding who is most vulnerable helps target prevention efforts. During the pandemic, certain demographics faced heightened risks. People in their thirties, for example, reported more incidents, possibly due to active online lives and frequent financial transactions. Vulnerable groups also include seniors, who may struggle with digital security or social isolation, making them easier targets for scams. Psychologically, victims often experience stress, anxiety, and a loss of trust, which can hinder recovery. The emotional toll varies but is significant across all demographics. Recognizing these vulnerabilities allows you to be more cautious, especially when managing sensitive information online or dealing with unfamiliar contacts. Awareness of psychological impacts helps you seek support and avoid falling further into victimization.

Frequently Asked Questions

How Do Digital Platforms Increase Identity Theft Risks During a Pandemic?

Digital platforms increase your risk of identity theft during a pandemic because they become primary channels for scams and fraud. You might fall for phishing emails, fake websites, or social engineering tricks that steal your personal information. As more people shop, work, and access services online, cybercriminals exploit vulnerabilities, making it easier for them to target you. Staying vigilant, using strong passwords, and verifying sources can help protect your identity.

What Specific Economic Factors Most Incentivize Fraudsters to Commit Identity Theft?

You’re most incentivized by financial hardship, as economic stress pushes some to commit fraud. The surge in online transactions offers more opportunities for theft, while government stimulus scams and unemployment fraud attract quick, easy gains. As the economy disrupts, fraudsters see more targets and financial motives. You can protect yourself by staying vigilant with your personal info, watching for scams, and using strong security measures online.

How Do Government Benefit Scams Evolve With Changing Pandemic Policies?

You should know that over $750 million was stolen through COVID-19 stimulus scams, highlighting how scammers adapt as pandemic policies change. As governments adjust relief measures, fraudsters modify their tactics—targeting new programs, exploiting loopholes, and using updated social engineering schemes. This evolution keeps victims vulnerable, especially when policies shift quickly, making it essential for you to stay informed and vigilant against evolving scams that leverage changing government support initiatives.

What New Cybercrime Tools Have Emerged Specifically Due to COVID-19?

You’ll notice new cybercrime tools that emerged during COVID-19, such as advanced phishing kits tailored to pandemic themes, fake websites mimicking government portals, and social engineering tactics exploiting health fears. Criminals also use sophisticated malware and remote access tools to compromise personal data. These tools make it easier for fraudsters to target individuals and organizations online, increasing the scale and effectiveness of identity theft and financial scams during the pandemic.

Why Are Some Demographics More Vulnerable to Identity Theft During Crises?

You’re more vulnerable to identity theft during crises if you’re in your thirties because you’re often highly active online, handling numerous transactions, and applying for benefits. Criminals target this demographic with scams related to government aid or job loss. You might also be less cautious or less aware of scams during stressful times, making you an easier target for fraudsters exploiting the chaos and digital reliance.

Conclusion

As the pandemic’s shadow lengthens, your digital world becomes both sanctuary and trap. Every click, a ripple in a vast ocean, where unseen currents of crime flow beneath. The rising tide of scams mirrors the storm within, challenging your resilience. But with awareness as your anchor and vigilance as your sail, you can navigate these turbulent waters. Together, you hold the power to turn this chaos into a beacon of hope and security.